Advanced Trading – Heikin Ashi Method

- Written by News Feature Team

One of the most popular trading strategies among the Forex trading community in Japan is the Heikin Ashi Method, also known as HA Method. The first person who used the Heikin Ashi Method was the prosperous Japanese rice merchant, but also a prosperous trader, Munehisa Homma. The reason why this technique is the preferred approach among advanced traders is that it is focused on the popular trend Candlesticks Strategy. Keep reading to find out more about this profitable trading method or, If you are a beginner, we would recommend you to start with Forex 1 minute scalping strategy.

Heikin Ashi Method & Candlesticks Strategy – The Perfect Match

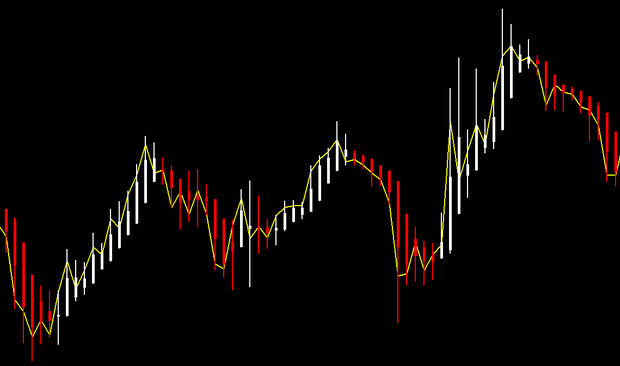

We can say that the Candlesticks Strategy and the Heikin Ashi Method work very well together. When you are using the Candlesticks strategies, Heikin Ashi Method is a Forex technique that allows you to not only easily identify patterns, trend reversals, but also positions. Heikin Ashi means “average bar” in Japanese, hence the name of Heikin Ashi Method, which is a technique that emphasises on the average trends of your choice.

Heikin Ashi Method – Main Features

According to the principles of the Heikin Ashi Method, we can say that if you want to detect an error-free trade, it is surely a quite difficult task unless you are following the appropriate lines. In its place, the HA Method focuses on:

* Clearly identify patterns.

* Spot cost-effective trend reversals.

* Quickly recognise entry and exit positions.

* Eliminate the noise in charts.

* Make recommendations on which features are not useful at the time.

Heikin Ashi Method – Estimating and Using Profitable Values

Needless to say: any critical error must be avoided; therefore, the Heikin Ashi Method is aimed to experienced traders. Not only should you be cautious and alert to the smallest details, but also qualified in estimating figures that are to be implemented on tight timeframes. Finally, you must be able to identifying large shifts in current prices and breakouts. In order to prepare your Heikin Ashi calculations, you should do as follows:

1) Calculate the values of the open HA, close HA, low HA, and high HA (see the table below).

2) Try to find the best entry position once you have fixed the values.

3) Try to find to set the best stop loss order.

4) Determine a take profit position.

|

Open HA |

Prior to bar’s opening price + Prior to bar’s closing price)/2 |

|

Close HA |

(Low + High +Opening price + Closing price)/4 |

|

Low HA |

Minimum X (Low, Opening price, Closing price) |

|

High HA |

Maximum X (High, Opening price, Closing price) |

Heikin Ashi Method – Conclusion

It may be worth saying that the Heikin Ashi Method is not advisable for beginners in Forex trading, because it is a quite direct technique, so you have to work hard on time series every day. In other words, you will need more than a few days to see the results, so be patient and willing to spend some time, and focus for your trading.