Commodity market update

- Written by NewsCo

It has been established so far that the economy is in recovery phase. Most asset prices have been rising in an uptrend since the turmoil in 2020. Inflation in the United states is rising, unemployment is going down, and China’s recent growth has been stellar (albeit partially a result of the way data is reported). All of this has been good news for commodities, which have been rising up with other asset classes.

Oil regains its glitter

Take oil, for example, which is trading now at round $63 per barrel after falling to below $20. It has been pushed up due to the return of stability to the market. The demand from China, the world’s biggest oil importer, as well the relative harmony between different members of OPEC and non-OPEC members seen in both November 2020 and March 2021, have kept the price buoyed.

Additionally, US oil (Texas crude oil) seems to have broken a major resistance line. This can indicate that the price will probably rise over the long term. Any supply shocks can cause the price to spike further up. We can potentially see the price of oil returning to previous peak levels at above $100 per barrel. Demand shocks, on the other hand, would cause the price to drop. Trading apps like Easymarkets can help you trade oil in both directions via contracts for difference.

Natural gas consolidates

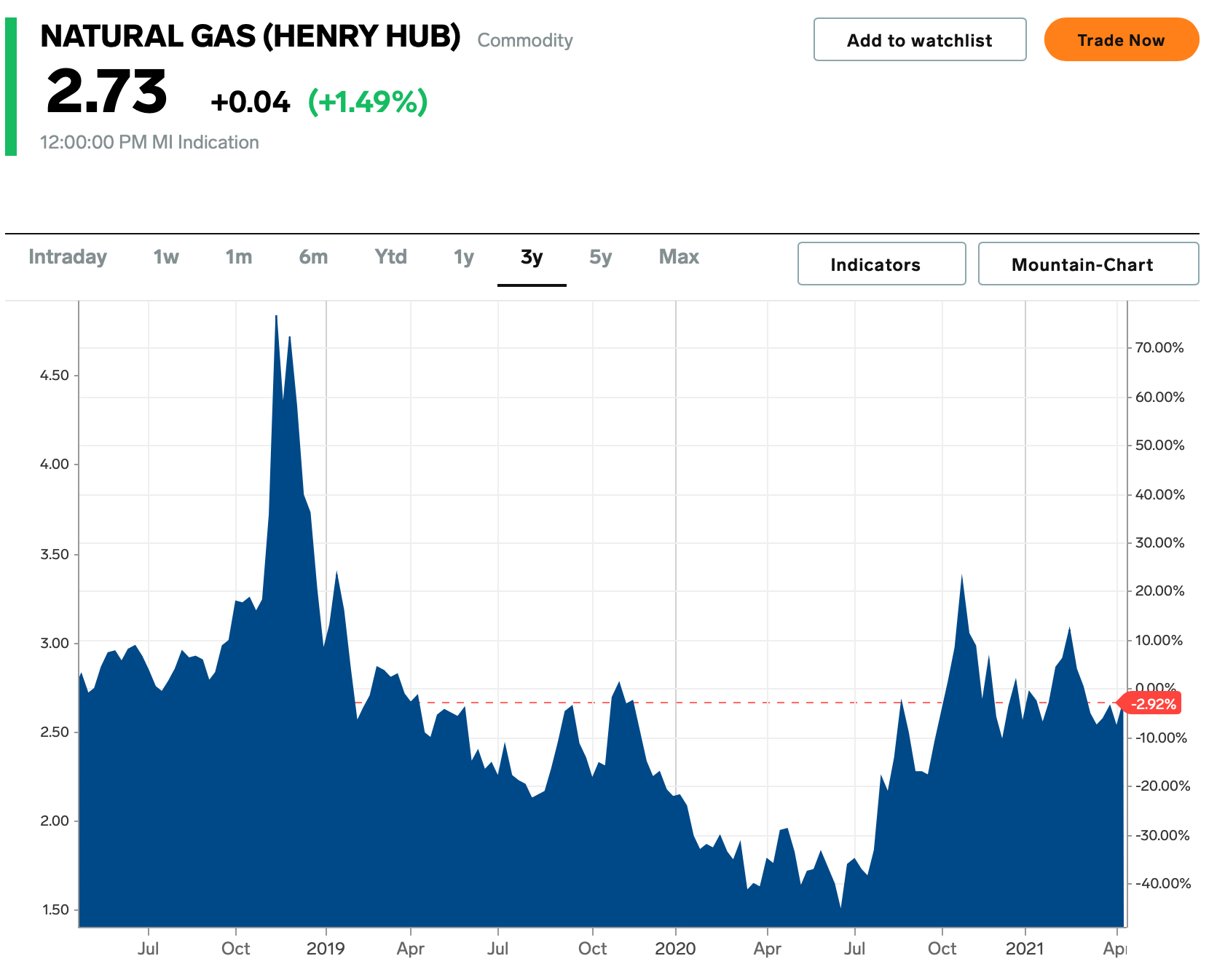

Natural gas prices went up in 2020, but it has been in consolidation since October 2020. The price went slightly up when The U.S. Energy Information Administration reported recently that domestic supplies of natural gas have increased by 61 billion cubic feet for the week ending on April 9, which is lower than the expected rise of of 65 billion cubic feet according to forecasts by analysts polled by S&P Global Platts.

Despite the recent consolidation, gas prices are also expected to continue to rise. This is likely to happen as European economies gradually reopen and return to normal activity. Russia is expected to remain the main supplier of natural gas to Europe. The prospects of gas remain bright over the short and medium terms, unless any shocks take place.

Gold loses its glitter

Unlike oil and gas - commodities that largely go hand in hand with economic growth - gold has been in a declining trend since it reached its peak back in August 2020, above $2000 for the ounce. As investor’s appetite for risk has gone up, gold has gone down. Currently, the price seems to be consolidating at above $1700.

The gold is a precious metal that usually shines during crisis. It is known to perform well when there is economic contraction (or recessions or depression), but in times of recovery, it loses its appeal. Compared to many other assets, Gold has been an underperformer in recent months.

While gold is not expected to decline heavily further, there are no clear drivers for it to go up strongly, either. The safest bet would be to expect gold to remain subdued in sideways movement.

Conclusion

Traders can safely expect commodities related to economic activity to continue to rise up, as vaccination rates go up and economies reopen. They can also expect safe heaven commodities such as gold to consolidate. Despite this, traders would do well to hold a small percentage of gold in their accounts as a hedging measure.