Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

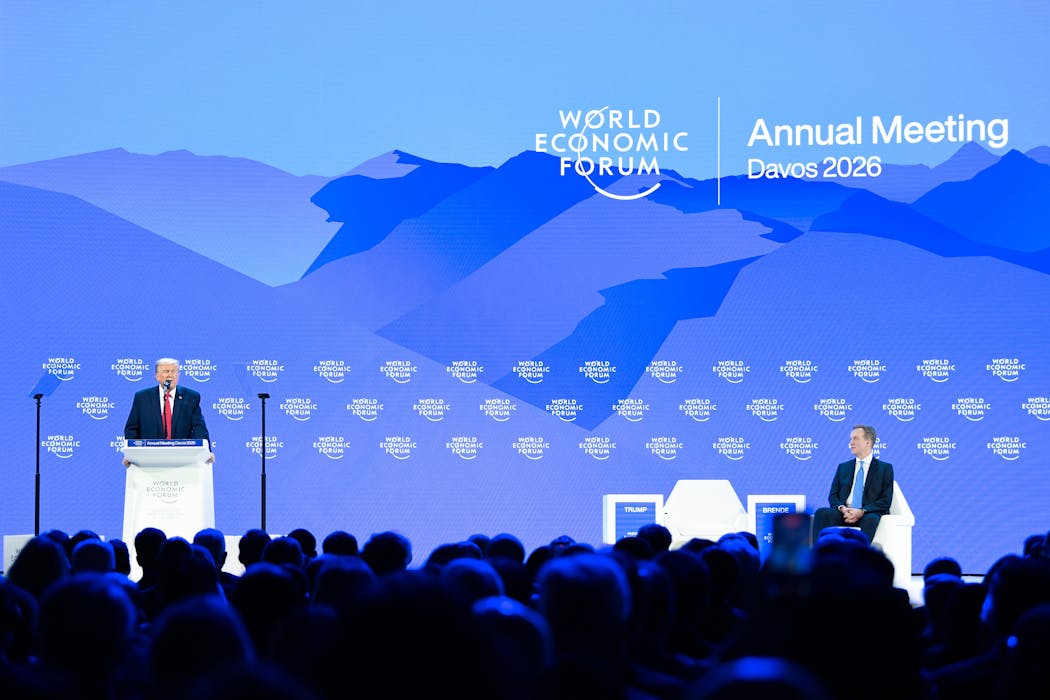

After months of speculation, US President Donald Trump confirmed he will be nominating Kevin Warsh as the next chair of the US Federal Reserve. The appointment has been closely watched in the context of Trump’s ongoing conflict with the Fed and its current chairman Jerome Powell.

The immediate reaction to the announcement was a significant crash in gold and silver markets. After months of record highs and stretched valuations, spot prices for gold and silver dropped 9% and 28% respectively after the announcement. The US stock market also fell, with major indexes all reporting modest losses.

However, in the context of concerns over Trump’s interference with the Fed, the market crash can ironically be understood as an early vote of confidence in Warsh’s independence and suitability for the role.

Understanding why requires the context of Trump’s ongoing conflict with the Federal Reserve, and the importance of central bank independence to our current global financial system.

Trump’s war with the Fed

The last year has seen Trump in an unprecedented conflict with the Federal Reserve.

Trump appointed current Chairman Jerome Powell back in 2017. However, the relationship quickly soured when Powell did not cut interest rates as quickly as Trump wanted. In characteristically colourful language, Trump has since called Powell a “clown” with “some real mental problems”, adding “I’d love to fire his ass”.

The war of words descended into legal threats. Trump’s Justice Department announced an investigation into Federal Reserve Governor Lisa Cook over alleged fraud in historical mortgage documents. Then last month, in a shocking escalation the Justice Department opened a criminal investigation into Powell relating to overspending in renovations of the Federal Reserve offices.

Both sets of allegations are widely viewed as baseless. However, Trump has tried to use the investigation as grounds to fire Cook. The case is currently before the Supreme Court.

Powell has hit back strongly at Trump, saying the legal threats were

a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.

Powell received support from 14 international central bank chiefs, who noted “the independence of central banks is a cornerstone of price, financial and economic stability”.

Historically, presidential interference with the Fed was a major cause of the stagflation crisis in the 1970s. More recently, both Argentina and Turkey have experienced significant financial crises caused by interference with central bank independence.

Who is Kevin Warsh?

Kevin Warsh is a former banker and Federal Reserve governor, who previously served as economic advisor to both President George W Bush and President Trump.

Originally Trump seemed likely to favour the current director of Trump’s National Economic Council, Kevin Hassett, for the job. However, Hassett was widely viewed as being too influenced by Trump, intensifying fears about Fed independence.

Warsh appears more independent and brings a reputation as an inflation “hawk”.

What is an inflation hawk?

The Federal Reserve is responsible for setting US interest rates. Put simply, lower interest rates can increase economic growth and employment, but risk creating inflation. Higher interest rates can control inflation, but at the cost of higher unemployment and lower growth.

Getting the balance right is the central role of the Federal Reserve. Central bank independence is essential to ensure this delicate task is guided by the best evidence and long-term needs of the economy, rather than the short-term political goals.

An inflation “hawk” refers to a central banker who prioritises fighting inflation, compared to a “dove” who prioritises growth and jobs.

From Warsh’s previous time at the Federal Reserve, he established a strong reputation as an inflation hawk. Even in the aftermath of the global financial crisis of 2008, Warsh was more worried about inflation than jobs.

Given Trump’s past conflict with Powell around cutting interest rates, Warsh might seem a curious choice of candidate.

More recently though, Warsh has moderated his views, echoing Trump’s criticism of the Fed and demands for lower interest rates. Whether this support will continue, or if his hawkish tendencies return leading to future conflict with Trump, remains to be seen.

The market reaction

The crash in gold and silver, and decline in stock markets, suggests investors view interest rate cuts as less likely under Warsh than alternative candidates.

Gold and silver prices typically rise in response to instability or fears of inflation.

The previous record highs were driven by many factors, including global instability, concerns over Fed independence, and a speculative bubble.

That Warsh’s appointment has triggered a market correction in precious metals means investors expect lower inflation, and greater financial stability. The US dollar trading higher also supports this view.

Read more: Silver and gold hit record highs – then crashed. Before joining the rush, you need to know this

The credibility of the Fed is at stake

The past month has seen much discussion of the changing world order. Canadian Prime Minister Mark Carney recently decried the end of the international rules-based order and called for a break from “American hegemony”.

The global dominance of the US dollar is a crucial plank of US economic hegemony. Though Trump clearly remains sceptical of central bank independence, his appointment of Warsh suggests he recognises the importance of retaining the credibility of the US currency and Federal Reserve.

Whether that recognition can continue to temper Trump’s instinct to interfere with the setting of interest rates remains to be seen.

Authors: The Conversation