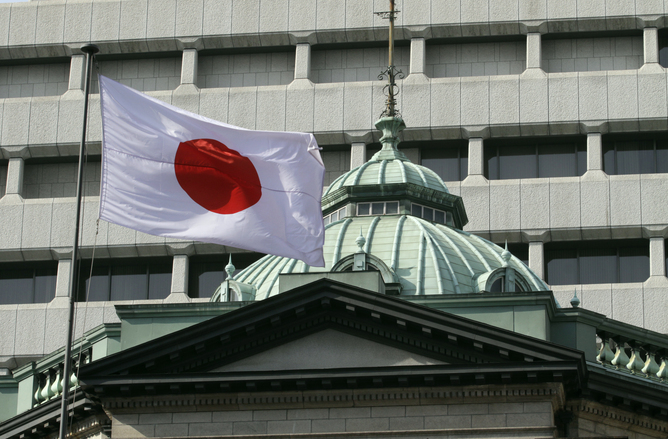

Japan’s central bank is out of control and must be tamed

- Written by Richard Werner Director, Centre for Banking, Finance and Sustainable Development at University of Southampton

In the second quarter of this year Japan recorded its largest GDP contraction since the earthquake and tsunami hit in 2011. This time, the single most important reason for the downturn is technical: demand surged in the first quarter (and the one before that) as consumers spent more ahead of a sales tax increase in April. Of course, the figures are not nearly as bad when one considers the more sensible year-on-year growth rates of nominal GDP: Consumption was flat on this basis and GDP expanded by 1.9%.

Nonetheless, the news came as a disappointment to all those observers and investors who had hoped that new policy initiatives from the prime minister, Shinzo Abe, would make a more dramatic difference and finally end Japan’s mammoth slump for good.

At first, it seemed Abe had the right idea. His election platform, which produced a landslide victory in late 2012, was centred on the single most important factor in Japan’s record-breaking depression: a central bank that is too independent, unaccountable and out of control, abusing its excessive powers to push through an austerity programme designed to implement a political agenda of deregulation, liberalisation and privatisation.

Alas, Abe addressed the issue only with rhetoric, not with deeds. Once in power he appointed a team of radicals who thought the bank should be more engaged, not less, and reneged on his promises to reduce the vast powers of the Bank of Japan.

True “quantitative easing” – which I first defined in 1995 as a set of policies to increase credit creation for productive purposes, such as bank lending to small businesses – has mostly been ignored. Instead, the Bank of Japan has redefined the expression to include largely irrelevant policy measures, such as increasing banks’ reserves at the central bank.

Abe’s advisers have now convinced him to shift attention away from true quantitative easing to measures such as the raised sales tax and further privatisation.

Supply and demand

This never made sense, as Abe correctly recognised in his election campaign: the 20-year slump has not been due to Japan’s economic structure, the so-called “supply side”. Economists talk of the “factors of production” that go into determining economic growth: land, labour, capital, technology – and over this period these factors haven’t declined nor become less productive.

Furthermore, Japan holds the world record for the longest period of deflation in any modern economy. As a result, even though headline GDP contracted by an average of 0.4% each year in the decade to 2013, Japan actually averaged 0.9% real GDP growth. The differences is thanks entirely to record deflation of 1.3% (real growth equals nominal growth minus inflation, hence in this case nominal GDP contraction plus deflation – -0.4% minus -1.3% – is, hey presto, positive real GDP growth).

What matters to businesses, employees and the government is, however, nominal growth, not so-called “real growth”: investment, turnover and profits are in nominal terms, salaries and wages are in nominal terms, and tax revenues and revenues from bond issuance are all in nominal terms.

Deflation and contracting nominal GDP are prime evidence that the problem has been a lack of demand, not supply: a lack of supply pushes up prices, a lack of demand pushes them down. With record unemployment and low-capacity utilisation it is clear that Japan has been suffering from excess supply and lack of demand.

Stimulating Japan?

But haven’t all the usual demand stimulation policies been tried over the past 20 years – and failed miserably? True, government spending programmes and interest rate reductions have been tried, but they couldn’t help Japan in the first place. The reason is the particular nature of the recession that began in about 1992: it is an economic slump due to a post-bubble banking-crisis.

During the 1980s, the Bank of Japan ordered Japanese banks to vastly increase bank credit creation for non-GDP (that is, speculative or financial) transactions. Such bank credit creation is always unsustainable, producing an asset bubble that must end in a banking crisis and recession.

That is what happened in around 1990, when bank credit creation slowed. The first speculators went bust, leaving bad debts in the banking system. Risk-averse banks lowered credit creation further, exacerbating the financial slump. Banks soon stopped lending to the real economy for productive purposes and as a result GDP growth slowed, the economy entered into a recession, unemployment rose and tax revenues collapsed.

At this juncture the government followed the advice by economists such as Richard Koo who argued – and still argue – that fiscal stimulation is the panacea to end Japan’s slump. Thanks to the ensuing futile public spending, Japan’s debt/GDP ratio has reached record levels and, as others warned, was entirely without positive effect: such spending could not increase bank credit creation and hence merely crowded out private demand. As a result, fiscal stimulation could not have any positive effect on the economy.

This is precisely what happened: research has shown that for every yen in government expenditure, private demand fell by one yen. The reason is that with unchanged bank credit creation the income pie is unchanged, but increased government spending raises the government’s share of that pie – thus shrinking private demand.

Likewise, interest rate reductions could not possibly help, since the price of money was never the problem. Instead, what has been missing is credit creation for productive purposes, such as loans to small businesses. As 97% of the money supply is actually bank credit produced whenever banks extend what is called a “bank loan”, such lending is the only way to increase nominal GDP and create an economic recovery within the current system.

Broken promises

So while Abe’s initial plan to take on Japan’s central bank was a good one, he did not keep his election promise to change the Bank of Japan Law. It remains unchanged. Abe and his team have become side-tracked and their policy drive has been blunted, in the same way that the Bank of Japan has blunted any serious policy drive to create a recovery in the past 20 years.

It is time for Abe to remember his main election promise and change the Bank of Japan Law so that the central bank cannot continue to work against him behind his back. Simultaneously, he should remember the policies that made his grandfather such a successful manager of the Japanese economy: guidance of bank credit creation for productive purposes. Credit creation could be boosted most easily by stopping the issuance of government bonds and instead funding the public sector borrowing requirement entirely by entering into loan contracts from Japan’s banks. This also remains a promising policy option for crisis-ridden Europe to end Japan’s slump.